After business school one of my professors connected me with a startup he was an advisor to. They hired me as a consultant to help them develop their business model and pricing, and to help identify strategic partners. We soon selected a very interesting partner, a non-profit with access to a lot of data that would be very valuable to the new service we were developing, and a meeting was arranged at their office to see whether a deal could be reached.

Although negotiation wasn't technically part of my brief I took the CEO aside and asked if he wanted help preparing for the discussion. In particular I suggested we spend the afternoon role-playing the negotiation, which he agreed to try. I played the part of the partner and raised the sorts of questions and concerns I thought were likely. It soon became clear that our CEO wasn't ready for the meeting. He understood our interests extremely well but not the other party's interests, particularly the non-financial ones. To his credit, the CEO also realized that he was probably the wrong person to do the negotiation. (Happily for me, he concluded I was the right person and I took his place in a fascinating and ultimately successful negotiation.)

For a role-play that didn't happen but should have, look at this brief video from Harvard's Project on Negotiation. Guhan Subramanian recounts how he was asked to mediate a board dispute over an organization's strategic direction. A meeting was set up and board members were asked to take their name placards and to sit wherever they chose around a large table. As people filed in, Guhan realized the problem -- everyone was sitting according to their "sides" which set the stage for an adversarial discussion rather than mutual problem solving. Worse, he had been brought in by one side and by chance the seat that the company's counsel had chosen for him was on "his" side, making it much harder for him to be seen as a credible mediator by those advocating the other strategic direction.

Negotiations are full of things that can go wrong. Experienced negotiators can avoid many pitfalls simply from knowledge but role-playing a negotiation, like a dress rehearsal for a play, can help identify other potential snags and increase the chances that the negotiation follows the path you've designed.

A blog about negotiation, touching on academic theory as well as practical examples ranging from big business to government to family and community.

Thursday, July 21, 2011

Wednesday, July 20, 2011

Negotiating with Children

After three recent posts in a row about politicians I thought I'd risk the cheap shots and change the topic to negotiating with children.

Negotiators (always eager to broaden our audience) regularly point out that negotiation doesn't just take place at work. People negotiate with neighbors, with spouses, with almost anyone we have relationships with. Certainly parents have to negotiate with children, and doing so in a positive way helps children grow up smart and makes parenting more fun.

Let me start by contrasting two parent-child negotiations. The first comes from Guhan Subramanian's book Negotiauctions: New Dealmaking Strategies for a Competitive Marketplace as Guhan negotiates the end to a game of catch with his five-year-old son:

as Guhan negotiates the end to a game of catch with his five-year-old son:

The second happened recently with one of my daughters, then four years old. We were about to drive half an hour and Morgan wanted to bring a toy in the car.

Morgan engaged in classic negotiation. She went beyond my position (no) to my interests (having her eat her snack and not having to deal with the toy being lost or damaged if she played with it at the park) and then proposed a solution that met my interests while still letting her bring her toy.

Guhan's son showed he understands the negotiation "dance" of competing offers. He made an aggressive request in order to bargain down to an acceptable number. It's an important real-world skill to have and a charming story, but I think parents should be cautious about encouraging this sort of haggling for three reasons.

First, while aggressive offers are often a correct tactic, they are contrary to relationship-building. When they become routine they are fundamentally dishonest. It's hard to build honest communication if every time either of you suggests a number of cookies, amount of TV time, number of stories or time the child has to be home it's understood that you don't really mean what you say -- you're just asking for more than you want or consider reasonable in order to negotiate.

Second, you won't always be able to haggle -- which will be confusing and frustrating children for whom the change is likely to feel arbitrary. Whatever negotiation you practice with your children should be as consistent as possible.

Finally, this sort of haggling is about value capture; I much prefer to emphasize value creation when negotiating with children. Value capture is essentially adversarial -- it's about getting more of what you want at the expense of someone else. Value creation is collaborative problem solving that genuinely makes everyone better off than before. It gives kids power to affect their world without removing your power as a parent and encourages them to work with you as partners in meeting their interests rather than as adversaries that need to be overcome.

Negotiators (always eager to broaden our audience) regularly point out that negotiation doesn't just take place at work. People negotiate with neighbors, with spouses, with almost anyone we have relationships with. Certainly parents have to negotiate with children, and doing so in a positive way helps children grow up smart and makes parenting more fun.

Let me start by contrasting two parent-child negotiations. The first comes from Guhan Subramanian's book Negotiauctions: New Dealmaking Strategies for a Competitive Marketplace

"I'll throw you five more pitches, and then it's time for dinner."

"Come on Dad...[pause for thought] ten more."

"Seven."

"Nine."

"Eight."

"OK, deal."

After the eight pitches are thrown and we're sitting at the dinner table, my five-year-old looks at me with a sly grin: "Hey Dad, guess what -- I only wanted eight pitches!"

I've never felt prouder.(Guhan offers this as an illustration of the midpoint rule, an important negotiation dynamic by which the final agreement is often midway between the opening offers from each party.)

The second happened recently with one of my daughters, then four years old. We were about to drive half an hour and Morgan wanted to bring a toy in the car.

Morgan: Daddy, can I bring this?

Me: No, sweetheart, not this time.

Morgan: Why?

Me: You need to eat your snack in the car and we're going to a park so I don't want your toy getting dirty or lost.

Morgan: I won't take it out of the car and you can hold on to it and only give it to me when I'm done with my snack.

Morgan engaged in classic negotiation. She went beyond my position (no) to my interests (having her eat her snack and not having to deal with the toy being lost or damaged if she played with it at the park) and then proposed a solution that met my interests while still letting her bring her toy.

Guhan's son showed he understands the negotiation "dance" of competing offers. He made an aggressive request in order to bargain down to an acceptable number. It's an important real-world skill to have and a charming story, but I think parents should be cautious about encouraging this sort of haggling for three reasons.

First, while aggressive offers are often a correct tactic, they are contrary to relationship-building. When they become routine they are fundamentally dishonest. It's hard to build honest communication if every time either of you suggests a number of cookies, amount of TV time, number of stories or time the child has to be home it's understood that you don't really mean what you say -- you're just asking for more than you want or consider reasonable in order to negotiate.

Second, you won't always be able to haggle -- which will be confusing and frustrating children for whom the change is likely to feel arbitrary. Whatever negotiation you practice with your children should be as consistent as possible.

Finally, this sort of haggling is about value capture; I much prefer to emphasize value creation when negotiating with children. Value capture is essentially adversarial -- it's about getting more of what you want at the expense of someone else. Value creation is collaborative problem solving that genuinely makes everyone better off than before. It gives kids power to affect their world without removing your power as a parent and encourages them to work with you as partners in meeting their interests rather than as adversaries that need to be overcome.

Monday, July 18, 2011

Negotiation is not about Compromise

A lot of people think that negotiation means compromise. I want something favorable to me, you want something favorable to you and we meet in the middle. This is often a dangerous mindset. Negotiation often includes compromise but the most useful tools of negotiation bypass compromise altogether. Let's examine just two of these tools.

Negotiators strive to find ways to meet interests at low or no cost. A "negotiator's fable" offers a good illustration. Two sisters each wanted an orange but they had just one orange between them. Each wanted the whole orange and neither had anything they could trade to the other that the other valued more than the fruit.

In the end, they compromised. Each took half the orange and went on her way. One sister happily ate her fruit, throwing away the peel. The other peeled her half, throwing away the fruit and using the peel to garnish a dish.

The compromise in this story was completely unnecessary. Each sister could have had the full value of the orange if they had identified each other's true interests and acted accordingly. Compromise destroyed value that was there for the taking.

Real world negotiations often offer similar opportunities for negotiating parties to meet each other's interests in creative ways that cost far less than their value.

Negotiators increase the value of a deal by identifying differences in relative valuation. If I'm selling you goods and want to deliver them in four months while you ask for two months we can compromise at three months. But should we? What if it costs me $100,000 to deliver in three months (vs. four) and $250,000 to deliver in two and it's worth $50,000 for you to receive in three (again, in comparison with four) and $500,000 to receive them in two months?

In that case, our compromise is our worst option, destroying $50,000 in value compared with delivery in four months and $250,000 in value compared with delivery in two months. If we negotiate well we won't compromise -- we'll settle on a higher price and delivery in two months.

Negotiators strive to find ways to meet interests at low or no cost. A "negotiator's fable" offers a good illustration. Two sisters each wanted an orange but they had just one orange between them. Each wanted the whole orange and neither had anything they could trade to the other that the other valued more than the fruit.

In the end, they compromised. Each took half the orange and went on her way. One sister happily ate her fruit, throwing away the peel. The other peeled her half, throwing away the fruit and using the peel to garnish a dish.

The compromise in this story was completely unnecessary. Each sister could have had the full value of the orange if they had identified each other's true interests and acted accordingly. Compromise destroyed value that was there for the taking.

Real world negotiations often offer similar opportunities for negotiating parties to meet each other's interests in creative ways that cost far less than their value.

Negotiators increase the value of a deal by identifying differences in relative valuation. If I'm selling you goods and want to deliver them in four months while you ask for two months we can compromise at three months. But should we? What if it costs me $100,000 to deliver in three months (vs. four) and $250,000 to deliver in two and it's worth $50,000 for you to receive in three (again, in comparison with four) and $500,000 to receive them in two months?

In that case, our compromise is our worst option, destroying $50,000 in value compared with delivery in four months and $250,000 in value compared with delivery in two months. If we negotiate well we won't compromise -- we'll settle on a higher price and delivery in two months.

Wednesday, July 13, 2011

Have the Republicans Trapped Themselves?

A very good rule of thumb for negotiations is that when someone makes a proposal they would normally avoid making, they see their own position as weak.

My last two posts took a critical and then an optimistic look at the maximalist approach taken by Republicans. Since then we've had some more days of discussions and some interesting gambits by Senate Minority Leader Mitch McConnell that make me suspect that the more negative post was also the more accurate.

The final point on my list of problems with a maximalist approach is that it can kill good deals. That seems to be where Republicans are now. Obama and the Democrats offered them a package that includes some tax increases but much larger cuts in spending. It's a deal that most people would regard as a victory for the Republican leadership (although Obama would likely claim some credit for putting the deal together) and that accomplishes far more for their agenda than it gives up.

The snag is that GOP leadership has said, loudly and often, that absolutely no tax increases would be acceptable. This pledge bears special political weight in a party that still remembers what happened to the first President Bush when he made a deal with Democrats that included new taxes and reneged on his "Read my lips" pledge.

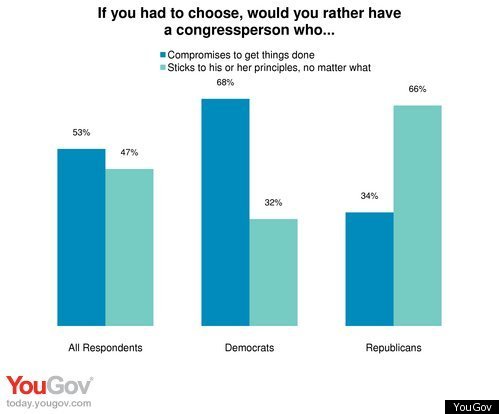

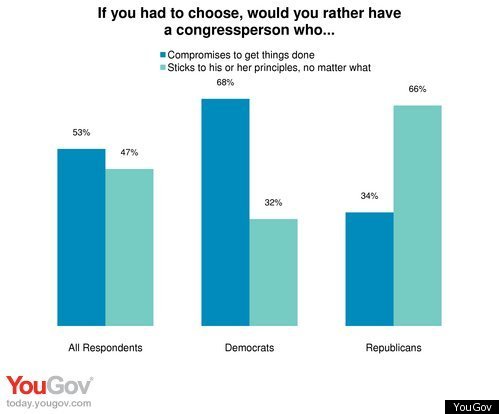

Another reason Republicans are reluctant to compromise, even for a deal that seems much in their favor, is that their base doesn't want them to. Consider this party divide from a recent Economist/YouGov poll:

(That poll indicates another problem with the debt ceiling negotiations: while 56% of Americans surveyed think defaulting on our debt would be "very serious" and 21% "somewhat serious" with 16% "unsure" it remains the case that 45% of respondents (and 74% of Republican respondents) think Congress should not raise the ceiling with only 29% (9% of Republicans) in favor of raising it. We seem aware that the consequences could be dire, but we still oppose preventing them.)

Obama's approach to the negotiation has been interesting. He recaptured a degree of initiative by suggesting a larger deficit reduction package of $4 trillion. This shifted him from responding to Republican demands for fiscal responsibility to having more of a co-leadership position but it also created the bind on the GOP discussed above. Having been offered a generous deal by Democrats that cuts government spending by far more than it increases taxes, how does the GOP look to independent voters (the ones that decide elections)? I think it's summed up by a friend of mine who said, "Independent voters (myself included) can easily see this was a great deal for Republicans. If they can't take it, then I really have no use for people more concerned with their pride than results."

In that environment, Mitch McConnell has made two gambits. The first is to ask that Obama take his $4 trillion proposal from the private negotiation table and make it public. This is a fairly shrewd gambit because as Obama has stated himself his package includes things that are painful for all parties. Such a proposal can potentially be agreed upon by the leadership of both parties and then accepted by rank-and-file members, but they fare poorly if exposed to death by a thousand cuts. If Obama puts his specifics in public view his plan will be attacked by the left for spending cuts and by the right for tax increases and Republicans will be able to walk away from it without political cost.

That said, Obama has already called his proposal one that involves political sacrifice for all sides and invoked Bob Dole's comment that the political boat doesn't sink if everyone gets in at the same time. It should be fairly easy for Obama to handle this gambit.

By far the more interesting gambit is McConnell's proposal to shift responsibility for increasing the debt ceiling from Congress to the White House. Specifically, he's proposed that the President be able to increase the debt ceiling almost unilaterally (Congress would need a two-thirds majority to prevent the increase) provided he offer a plan for reducing spending by a greater amount.

There are some clear positives for Republicans in this proposal. Increasing the debt ceiling is unpopular among Americans (in part because many assume it reflects new spending rather than paying existing commitments) and this proposal would allow Republicans to vote "no" every time the Obama administration needs to do so. Presumably some Democrats would be forced to vote "yes" so from the perspective of political theatre there's an obvious appeal to Republican candidates being able to say, "I voted against the Obama debt ceiling increases" or "My Democratic opponent voted for them". McConnell has added to the theater value by requiring Obama to make three separate requests for the $2.4 trillion that will be required between now and the next Presidential election.

That doesn't change the fact that this is an awful proposal for Congressional Republicans. You don't generally avoid blame for something you're responsible for by visibly punting that responsibility to someone else. Instead of taking a package of large spending cuts, McConnell's gambit would let the debt ceiling rise with no spending cuts whatsoever. (Granted, future cuts aren't binding on future congresses, but a Presidential proposal is even less so.) Having used the debt ceiling as a weapon to compel policy concessions from Democrats, McConnell's plan would give that weapon up entirely.

It's also a proposal that should be fairly easy for Democrats to neutralize (if they want to) without much political cost. Obama, Reid and Pelosi can argue that this is a political stunt designed to free Republicans from having to govern, and Reid and Pelosi in particular can argue that giving up such a significant component of Congress's power of the purse is antithetical to the separation of powers that are a foundation of our system of government.

It seems pretty clear that Republicans would not have proposed this if they were happy with their current situation. The question is, what follows? The trap Republicans have created for themselves (assuming my analysis is correct) is still one that makes reaching any sort of agreement difficult but they have also signaled a willingness to swerve rather than take the country into potential default. There must be some temptation on the Democratic side to stick to their current "bottom line" but the longer each party digs in the greater the chance that negotiations break down altogether. I still think that's unlikely, but by no means impossible.

My last two posts took a critical and then an optimistic look at the maximalist approach taken by Republicans. Since then we've had some more days of discussions and some interesting gambits by Senate Minority Leader Mitch McConnell that make me suspect that the more negative post was also the more accurate.

The final point on my list of problems with a maximalist approach is that it can kill good deals. That seems to be where Republicans are now. Obama and the Democrats offered them a package that includes some tax increases but much larger cuts in spending. It's a deal that most people would regard as a victory for the Republican leadership (although Obama would likely claim some credit for putting the deal together) and that accomplishes far more for their agenda than it gives up.

The snag is that GOP leadership has said, loudly and often, that absolutely no tax increases would be acceptable. This pledge bears special political weight in a party that still remembers what happened to the first President Bush when he made a deal with Democrats that included new taxes and reneged on his "Read my lips" pledge.

Another reason Republicans are reluctant to compromise, even for a deal that seems much in their favor, is that their base doesn't want them to. Consider this party divide from a recent Economist/YouGov poll:

(That poll indicates another problem with the debt ceiling negotiations: while 56% of Americans surveyed think defaulting on our debt would be "very serious" and 21% "somewhat serious" with 16% "unsure" it remains the case that 45% of respondents (and 74% of Republican respondents) think Congress should not raise the ceiling with only 29% (9% of Republicans) in favor of raising it. We seem aware that the consequences could be dire, but we still oppose preventing them.)

Obama's approach to the negotiation has been interesting. He recaptured a degree of initiative by suggesting a larger deficit reduction package of $4 trillion. This shifted him from responding to Republican demands for fiscal responsibility to having more of a co-leadership position but it also created the bind on the GOP discussed above. Having been offered a generous deal by Democrats that cuts government spending by far more than it increases taxes, how does the GOP look to independent voters (the ones that decide elections)? I think it's summed up by a friend of mine who said, "Independent voters (myself included) can easily see this was a great deal for Republicans. If they can't take it, then I really have no use for people more concerned with their pride than results."

In that environment, Mitch McConnell has made two gambits. The first is to ask that Obama take his $4 trillion proposal from the private negotiation table and make it public. This is a fairly shrewd gambit because as Obama has stated himself his package includes things that are painful for all parties. Such a proposal can potentially be agreed upon by the leadership of both parties and then accepted by rank-and-file members, but they fare poorly if exposed to death by a thousand cuts. If Obama puts his specifics in public view his plan will be attacked by the left for spending cuts and by the right for tax increases and Republicans will be able to walk away from it without political cost.

That said, Obama has already called his proposal one that involves political sacrifice for all sides and invoked Bob Dole's comment that the political boat doesn't sink if everyone gets in at the same time. It should be fairly easy for Obama to handle this gambit.

By far the more interesting gambit is McConnell's proposal to shift responsibility for increasing the debt ceiling from Congress to the White House. Specifically, he's proposed that the President be able to increase the debt ceiling almost unilaterally (Congress would need a two-thirds majority to prevent the increase) provided he offer a plan for reducing spending by a greater amount.

There are some clear positives for Republicans in this proposal. Increasing the debt ceiling is unpopular among Americans (in part because many assume it reflects new spending rather than paying existing commitments) and this proposal would allow Republicans to vote "no" every time the Obama administration needs to do so. Presumably some Democrats would be forced to vote "yes" so from the perspective of political theatre there's an obvious appeal to Republican candidates being able to say, "I voted against the Obama debt ceiling increases" or "My Democratic opponent voted for them". McConnell has added to the theater value by requiring Obama to make three separate requests for the $2.4 trillion that will be required between now and the next Presidential election.

That doesn't change the fact that this is an awful proposal for Congressional Republicans. You don't generally avoid blame for something you're responsible for by visibly punting that responsibility to someone else. Instead of taking a package of large spending cuts, McConnell's gambit would let the debt ceiling rise with no spending cuts whatsoever. (Granted, future cuts aren't binding on future congresses, but a Presidential proposal is even less so.) Having used the debt ceiling as a weapon to compel policy concessions from Democrats, McConnell's plan would give that weapon up entirely.

It's also a proposal that should be fairly easy for Democrats to neutralize (if they want to) without much political cost. Obama, Reid and Pelosi can argue that this is a political stunt designed to free Republicans from having to govern, and Reid and Pelosi in particular can argue that giving up such a significant component of Congress's power of the purse is antithetical to the separation of powers that are a foundation of our system of government.

It seems pretty clear that Republicans would not have proposed this if they were happy with their current situation. The question is, what follows? The trap Republicans have created for themselves (assuming my analysis is correct) is still one that makes reaching any sort of agreement difficult but they have also signaled a willingness to swerve rather than take the country into potential default. There must be some temptation on the Democratic side to stick to their current "bottom line" but the longer each party digs in the greater the chance that negotiations break down altogether. I still think that's unlikely, but by no means impossible.

Thursday, July 7, 2011

Crazy Like Foxes?

Yesterday I wrote about the current debt ceiling negotiations taking place in the U.S. in a pretty negative light. In particular I contrasted the Republican "maximalist with ultimatum" approach to the win-win approach that has come to dominate the business world as its value has become apparent.

There is, however, another perspective -- one that paints the Republicans in particular in a more favorable light (as negotiators). As David Brooks recently put it, "Republican leaders have also proved to be effective negotiators. They have been tough and inflexible and forced the Democrats to come to them." We'll explore that today.

In his comments to yesterday's post, David DesJardins pointed out an important potential problem with my comparison. Business negotiations are easier to make win-win because each party's primary goal is to maximize their own profit in absolute terms rather than relative to their counterpart. If a deal earns me $10 million and earns you $30 million I'm only "unhappy" because it suggests I could have done a better job of value capture. I'd most likely prefer that outcome to one where I made $10 million and you made $10 million and I'd certainly prefer it to a deal where I made $9 million.

In two-party electoral politics, the dynamic is very different. Elections are close to zero-sum: with few exceptions the main elected offices will go to Democrats or Republicans, so a gain for one is an equal loss for the other. This means that for the purposes of electoral success there will be relatively few opportunities to create value. As David points out, in the extreme case where all the parties care about is retaining their power the policies they enact are almost irrelevant compared with the effort to claim credit and avoid blame for their effects.

I suspect that anyone who follows politics will find this analysis unsurprising (if depressing) but today's post is optimistic, both about the strategy the Republicans have adopted and about their intent. That is, I'm assuming for the sake of discussion that they are acting out of a sincere belief that reducing government spending is a national priority, that tax increases would be very harmful, and that seeking the one while preventing the other is worth a very aggressive and potentially dangerous negotiating approach.

The Value of Intransigence

When a ZOPA is very large (and is known by both parties to be large), there is value in being unable to accept an even division of value. Imagine that we're negotiating over how to divide a million dollars between us. If I say, "How about $100K to you and $900K to me," you'd most likely refuse angrily. But suppose some external factor made it impossible for me to accept less than $900,000? Maybe the eccentric millionaire who set up the game stipulated that as a rule. In that case you wouldn't even be angry with me. But what if I'd entered into a binding commitment with a third party that if I accepted anything less than $900,000 I would owe the third party two million dollars? That side agreement would mean that my BATNA ($0) would be better than any division where I got less than $900,000 so you would know that there's no deal if you don't yield.

If I can credibly claim that I can't or won't take less than $900,000 you're faced with the choice of taking $100,000 or nothing. Not very many people will turn down that much money out of spite or in the name of fairness. (If you think you would turn down $100,000 just increase the size of the money. Would you turn down $10,000,000 because I was getting $90,000,000?)

Looked at another way, if you're in a game of chicken and both cars are speeding towards each other there's value in being able to throw your steering wheel out the window, provided the other driver can see you do it.

The Republicans have taken a number of steps to throw their steering wheel away:

There is, however, another perspective -- one that paints the Republicans in particular in a more favorable light (as negotiators). As David Brooks recently put it, "Republican leaders have also proved to be effective negotiators. They have been tough and inflexible and forced the Democrats to come to them." We'll explore that today.

In his comments to yesterday's post, David DesJardins pointed out an important potential problem with my comparison. Business negotiations are easier to make win-win because each party's primary goal is to maximize their own profit in absolute terms rather than relative to their counterpart. If a deal earns me $10 million and earns you $30 million I'm only "unhappy" because it suggests I could have done a better job of value capture. I'd most likely prefer that outcome to one where I made $10 million and you made $10 million and I'd certainly prefer it to a deal where I made $9 million.

In two-party electoral politics, the dynamic is very different. Elections are close to zero-sum: with few exceptions the main elected offices will go to Democrats or Republicans, so a gain for one is an equal loss for the other. This means that for the purposes of electoral success there will be relatively few opportunities to create value. As David points out, in the extreme case where all the parties care about is retaining their power the policies they enact are almost irrelevant compared with the effort to claim credit and avoid blame for their effects.

I suspect that anyone who follows politics will find this analysis unsurprising (if depressing) but today's post is optimistic, both about the strategy the Republicans have adopted and about their intent. That is, I'm assuming for the sake of discussion that they are acting out of a sincere belief that reducing government spending is a national priority, that tax increases would be very harmful, and that seeking the one while preventing the other is worth a very aggressive and potentially dangerous negotiating approach.

The Value of Intransigence

When a ZOPA is very large (and is known by both parties to be large), there is value in being unable to accept an even division of value. Imagine that we're negotiating over how to divide a million dollars between us. If I say, "How about $100K to you and $900K to me," you'd most likely refuse angrily. But suppose some external factor made it impossible for me to accept less than $900,000? Maybe the eccentric millionaire who set up the game stipulated that as a rule. In that case you wouldn't even be angry with me. But what if I'd entered into a binding commitment with a third party that if I accepted anything less than $900,000 I would owe the third party two million dollars? That side agreement would mean that my BATNA ($0) would be better than any division where I got less than $900,000 so you would know that there's no deal if you don't yield.

If I can credibly claim that I can't or won't take less than $900,000 you're faced with the choice of taking $100,000 or nothing. Not very many people will turn down that much money out of spite or in the name of fairness. (If you think you would turn down $100,000 just increase the size of the money. Would you turn down $10,000,000 because I was getting $90,000,000?)

Looked at another way, if you're in a game of chicken and both cars are speeding towards each other there's value in being able to throw your steering wheel out the window, provided the other driver can see you do it.

The Republicans have taken a number of steps to throw their steering wheel away:

- Very public statements about both the amount of deficit reduction they require and the insistence that no tax increases be included. Most dramatically, Republican leaders walked out of negotiations with Biden on the grounds that there was no point to having talks as long as Democrats were keeping tax increases on the table. While such statements aren't legally binding they create electoral damage if Republicans go back on them. (Think the first Bush and "read my lips.") This is like my side deal.

- Use of Tea Party zealots. From time to time freshman representatives have made fairly reckless and absolutist statements. Obama and the Democrats might call the bluff of elder statesmen in the GOP, knowing them long enough to believe they wouldn't willingly cause a default but the true believers serve a dual purpose. Republicans can claim that a moderate package won't pass and they can point to the political pressure they're under from the Tea Party.

- Claims that maybe a default wouldn't be so bad. It's been generally accepted as an article of faith that any default -- even temporary -- on our debt obligations would have serious, long-term ramifications for us and for the world economy. The GOP has been slowly challenging this notion over the past several months. Some prominent Republican economists have argued that a temporary default (i.e. a delay in paying interest) wouldn't bother the bond markets if it were seen as part of getting our fiscal house in order. One in particular compared it with someone who was a week late on their mortgage payment because they were putting their personal finances in order. Another popular line has been that while a default would be very bad it would be even worse to raise the debt ceiling without substantially reducing our budget deficit. Imagine our game of chicken again: if I can convince you that I think we're riding in bumper cars and that a crash won't hurt us, does that affect your thoughts on swerving first?

There are some clear indications that this approach has worked -- yielding impressive results for a party who controls the House of Representatives but not the Senate or the Presidency. Reid and Obama have indicated a willingness to cut spending dramatically, including a limited willingness to cut Medicare spending. After at first insisting that a deficit reduction package should include tax increases the Democrats are now fighting for the closing of some small "loopholes" that represent a small fraction of the spending cuts being considered. Brooks calls the current offer "the deal of the century: trillions of dollars in spending cuts for a few hundred billion dollars of revenue increases".

That's something of an overstatement. Obama has separately stated that he will not support any further extension of the Bush tax cuts on high earners; those tax cuts are set to expire next year and I don't believe Republicans have made a permanent extension part of the deal, although Republicans have said that agreeing to let them expire is off the table. That issue may be left to next year, at which point the Democrats would likely have a much stronger hand. Still, it seems likely that Republicans are in a position to agree a deal that gives them more than they could have achieved without the hardball tactics.

Likely, but not guaranteed. Some Republicans will vote against increasing the debt ceiling at all, and some Democrats are likely to reject the initial agreement due to the perceived imbalance. While some of the rhetoric is moving towards compromise there's no shortage of members of both parties saying they're willing to vote against a package they consider unacceptable.

The Chinese have a curse, "May you live in interesting times." It will be interesting to see whether these negotiations lead to a successful result.

Wednesday, July 6, 2011

Debt Ceiling Negotiations and the Dangers of Maximalism

The key to human advancement is our ability to build on the achievements of the past. The people who are bringing us cures to diseases and exploring the outermost reaches of space and the fundamental nature of matter would be swinging clubs and digging for edible roots if they didn't have access to everything people have done before.

Similar development happens in all areas of human endeavor. A modern chess Grandmaster with a time machine would make short work of past world champions, manufacturing experts have a structurally superior understanding of their processes (not just better machines) and modern negotiators are far more effective at getting good results than their predecessors.

Unfortunately, advances in a field are not always captured by people for whom that field isn't a core competence. Government in particular seems vulnerable to falling behind the advances of the business world and our current debt limit negotiations are a potentially disastrous example.

I'm going to do a post soon exploring how the current negotiating strategies by both parties could prove effective but today I'm going to look at what I think is the more likely scenario -- that they are inefficient, likely to lead to missed opportunities and have a very real potential to do us great harm.

The basic strategy taken by the Republican party has been maximalism backed up by ultimatum. They have demanded massive reductions in spending and declared as a matter of principle that absolutely no tax increases can be part of the deficit reduction package. If their terms aren't met they will not authorize an increase in the debt ceiling, which presumably would cause the United States to default on their debt.

To illustrate the weaknesses of this approach I want to explore it using a simpler example -- a company that makes customized heavy equipment negotiating a deal with a customer. Both sides have a general sense that the deal is worth about $10 million, and in fact the seller knows that the deal is attractive at any price of $8 million or more while the buyer knows it's attractive for them at any price of $12 million or less.

A maximalist approach would see the buyer offer $3 million for the equipment, while the seller insists that they need $20 million. Then the dance begins, with each offering concessions until finally they (hopefully!) complete the deal somewhere within the ZOPA. Even if they do make a deal, their approach is costly in many ways:

1. It's inefficient. Negotiations are often time-consuming affairs. At best, a maximalist approach still involves a much longer dance of mutual concessions until the parties reach the ZOPA.

Think how many months, how many high-level meetings and how many hours of staff time have been spent on the debt ceiling negotiations so far, with both sides still largely sticking to their maximalist positions. Think of the wasted energy at the Treasury department as they buy time for negotiations (we theoretically hit the debt ceiling a while back; the August 2 deadline is when Geitner's maneuvers can no longer prevent a default on some of our obligations). Only the most anti-government zealot would see this as a good thing, and it's certainly not something we'd like to emulate in our own negotiations.

2. It erodes trust. If you offer me $3 million and I counter with $20, how has the negotiation affected our relationship by the time we agree on $10 million? An unreasonable demand -- especially when both parties know it's unreasonable -- is also inherently a dishonest one. This is compounded when we back up our offers with statements like, "We'll lose money if we sell it for less than $15 million," or "I'd be violating my duty to shareholders if I paid you more than $7 million."

3. It's a reinforcing trap. Suppose you're buying something from me and I claim I can't sell it for less than $100 but eventually agree to $40. The next time you (or anyone familiar with that negotiation) deals with me, they're going to discount my initial claim by 60%. If I decide I've had enough with maximalism and make a reasonable initial offer to sell for $50 I'm going to find myself facing a client who is unwilling to pay above $20. Like a vendor in a market where extreme offers and heavy haggling are commonplace, I lose the option to negotiate more reasonably.

4. It destroys opportunities to create value. Suppose you're the buyer in our heavy equipment example. The factory that is going to use the equipment is ahead of schedule, so you really want to complete the deal in a timely fashion. Every month that you spend in negotiations will cost you $2 million in lost profit. What you don't know is that the seller could speed up manufacture of your equipment at a cost of $500,000.

For modern negotiators this is easy money. They will quickly identify that accelerating delivery is worth more to the customer than it costs the vendor and adjust the contract accordingly. A maximalist is much less likely to find opportunities like this both because they are wasting effort on unreasonable demands but also because less information tends to be shared when trust is lower.

Identifying value creating opportunities is certainly possible for maximalists -- it's just harder. Going back to the debt ceiling negotiations, for example, I think it's extremely unlikely that there are absolutely no tradeoffs involving tax increases that both parties would consider preferable. Republicans have virtually taken those possibilities off the table -- or at the very least, made it politically costly to enact them, which may amount to the same thing.

5. It can kill a good deal. We like to assume that people are generally rational and that given the opportunity to make money or burn it we'll choose to make it every time. Reality does not always bear this out. Negotiation history shows many examples where deals like our hypothetical heavy equipment contract failed because each side became trapped by their own statements or demands.

I think the odds strongly favor a deal being done to increase our debt ceiling but I don't for a moment consider it a foregone conclusion. Democrats and Republicans have made very public statements about what they can possibly accept and those statements have no ZOPA. As the rhetoric heats up, each party adds to the political cost of giving in to the other's demands and, from a psychological standpoint, increases the risk that they succumb to a number of cognitive biases. As one observer pointed out, a game of chicken can end tragically even if both parties are willing to swerve; in Rebel Without a Cause, the decision to bail out was "trumped" by a jacket getting stuck to a car door.

In this case we're all in the car with them. For my part, I wish we were playing a more constructive game than chicken.

Similar development happens in all areas of human endeavor. A modern chess Grandmaster with a time machine would make short work of past world champions, manufacturing experts have a structurally superior understanding of their processes (not just better machines) and modern negotiators are far more effective at getting good results than their predecessors.

Unfortunately, advances in a field are not always captured by people for whom that field isn't a core competence. Government in particular seems vulnerable to falling behind the advances of the business world and our current debt limit negotiations are a potentially disastrous example.

I'm going to do a post soon exploring how the current negotiating strategies by both parties could prove effective but today I'm going to look at what I think is the more likely scenario -- that they are inefficient, likely to lead to missed opportunities and have a very real potential to do us great harm.

The basic strategy taken by the Republican party has been maximalism backed up by ultimatum. They have demanded massive reductions in spending and declared as a matter of principle that absolutely no tax increases can be part of the deficit reduction package. If their terms aren't met they will not authorize an increase in the debt ceiling, which presumably would cause the United States to default on their debt.

To illustrate the weaknesses of this approach I want to explore it using a simpler example -- a company that makes customized heavy equipment negotiating a deal with a customer. Both sides have a general sense that the deal is worth about $10 million, and in fact the seller knows that the deal is attractive at any price of $8 million or more while the buyer knows it's attractive for them at any price of $12 million or less.

A maximalist approach would see the buyer offer $3 million for the equipment, while the seller insists that they need $20 million. Then the dance begins, with each offering concessions until finally they (hopefully!) complete the deal somewhere within the ZOPA. Even if they do make a deal, their approach is costly in many ways:

1. It's inefficient. Negotiations are often time-consuming affairs. At best, a maximalist approach still involves a much longer dance of mutual concessions until the parties reach the ZOPA.

Think how many months, how many high-level meetings and how many hours of staff time have been spent on the debt ceiling negotiations so far, with both sides still largely sticking to their maximalist positions. Think of the wasted energy at the Treasury department as they buy time for negotiations (we theoretically hit the debt ceiling a while back; the August 2 deadline is when Geitner's maneuvers can no longer prevent a default on some of our obligations). Only the most anti-government zealot would see this as a good thing, and it's certainly not something we'd like to emulate in our own negotiations.

2. It erodes trust. If you offer me $3 million and I counter with $20, how has the negotiation affected our relationship by the time we agree on $10 million? An unreasonable demand -- especially when both parties know it's unreasonable -- is also inherently a dishonest one. This is compounded when we back up our offers with statements like, "We'll lose money if we sell it for less than $15 million," or "I'd be violating my duty to shareholders if I paid you more than $7 million."

3. It's a reinforcing trap. Suppose you're buying something from me and I claim I can't sell it for less than $100 but eventually agree to $40. The next time you (or anyone familiar with that negotiation) deals with me, they're going to discount my initial claim by 60%. If I decide I've had enough with maximalism and make a reasonable initial offer to sell for $50 I'm going to find myself facing a client who is unwilling to pay above $20. Like a vendor in a market where extreme offers and heavy haggling are commonplace, I lose the option to negotiate more reasonably.

4. It destroys opportunities to create value. Suppose you're the buyer in our heavy equipment example. The factory that is going to use the equipment is ahead of schedule, so you really want to complete the deal in a timely fashion. Every month that you spend in negotiations will cost you $2 million in lost profit. What you don't know is that the seller could speed up manufacture of your equipment at a cost of $500,000.

For modern negotiators this is easy money. They will quickly identify that accelerating delivery is worth more to the customer than it costs the vendor and adjust the contract accordingly. A maximalist is much less likely to find opportunities like this both because they are wasting effort on unreasonable demands but also because less information tends to be shared when trust is lower.

Identifying value creating opportunities is certainly possible for maximalists -- it's just harder. Going back to the debt ceiling negotiations, for example, I think it's extremely unlikely that there are absolutely no tradeoffs involving tax increases that both parties would consider preferable. Republicans have virtually taken those possibilities off the table -- or at the very least, made it politically costly to enact them, which may amount to the same thing.

5. It can kill a good deal. We like to assume that people are generally rational and that given the opportunity to make money or burn it we'll choose to make it every time. Reality does not always bear this out. Negotiation history shows many examples where deals like our hypothetical heavy equipment contract failed because each side became trapped by their own statements or demands.

I think the odds strongly favor a deal being done to increase our debt ceiling but I don't for a moment consider it a foregone conclusion. Democrats and Republicans have made very public statements about what they can possibly accept and those statements have no ZOPA. As the rhetoric heats up, each party adds to the political cost of giving in to the other's demands and, from a psychological standpoint, increases the risk that they succumb to a number of cognitive biases. As one observer pointed out, a game of chicken can end tragically even if both parties are willing to swerve; in Rebel Without a Cause, the decision to bail out was "trumped" by a jacket getting stuck to a car door.

In this case we're all in the car with them. For my part, I wish we were playing a more constructive game than chicken.

Subscribe to:

Comments (Atom)